Research Policy Analysis and Coordination

Budget and Budget Justification Instructions

Jump to:

- Proposed Budget for Project

- Composite Budget (Exhibit B)

- Budget Justification (Exhibit B1)

- Subawardee Budgets (Exhibit B2)

- Invoice Elements (Exhibit B3)

The University and the PI have primary responsibility for understanding what costs are allowable on sponsored projects and determining if costs should be directly budgeted and charged to a project, or considered indirect costs and charged to the appropriate unrestricted account. The PI is also responsible for using funds in a manner consistent with State and University regulations, as well as any additional restrictions set forth in the agreement between the parties.

Costs are identified as either direct or indirect costs. Direct costs are costs that can be identified specifically with a particular sponsored project, an instructional activity, or any other institutional activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. These costs should be detailed in the final approved budget (see below and provision 14 of the UTC (PDF)) and can be directly charged to the sponsored project. Indirect costs are valid expenses of conducting research, instruction and other sponsored activities at University, but are incurred for common or joint objectives and therefore cannot be identified readily and specifically with a particular project or program. (Examples of University indirect costs include expenses for payroll, accounting and utilities.) Indirect costs are reimbursed through the Indirect Cost rate (IDC). Absent a statute or regulation to the contrary, the Universities intend to charge the rate to the award based on the Modified Total Direct Costs (MTDC, defined below) of each project.

Direct Expenditures

To provide State agencies with the necessary flexibility to achieve the objectives of each project, the following provides guidance on determining appropriate direct expenditures to be charged to State agency agreements.

Direct expenditures charged to agency projects must be allowable according to the terms and conditions of the Agreement and the approved budget (Exhibit B), in accordance with State and University policy. All expenditures charged in similar circumstances will be treated consistently, regardless of funding source.

All direct expenditures shall be attributed with relative ease to a specific activity or project or multiple projects based on its direct benefit to the project or projects. If costs are to be attributed between multiple projects, there must be supporting documentation of how the pro-rated costs were attributed between the projects. If the benefit is spread over multiple projects and it is difficult to identify the direct benefit to each project with reasonable diligence, the cost must be considered an indirect cost. Refer to Indirect Cost under the Budget Narrative/Justification section, below.

See below for more details on budget categories and expenditures.

Proposed Budget for Project

Each budget category listed on the proposed budget (Exhibit B) must be justified as necessary to accomplish the Scope of Work in the Budget Narrative/Justification (Exhibit B1). If the proposed project includes amounts for subrecipients, the composite budget for each subrecipient will be included in Exhibit B2.

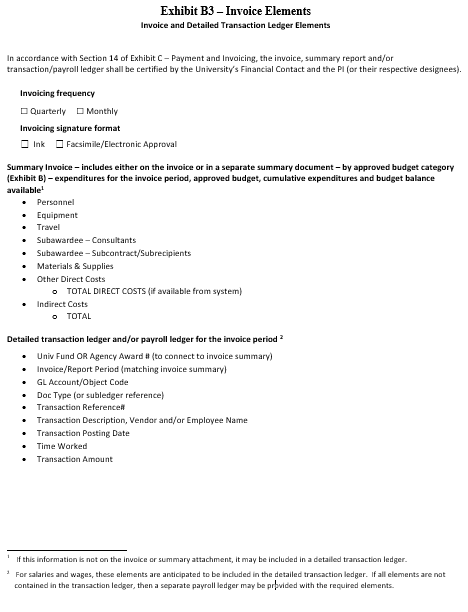

Composite Budget (Exhibit B)

Each campus will follow its established budget process to populate the composite budget, Exhibit B. If awarded, Exhibit B will be incorporated into the Agreement. The composite budget timeframe can be adjusted to reflect project needs. Some State agencies may request a task-based budget in addition to the Composite Budget (Exhibit B) or require more budget detail and the parties may mutually agree to such modifications.

Annual Budget Flexibility: Please see the Budget Flexibility section of this Guide and section 15.B Budget Flexibility in the UTC (PDF).

Program Income, when anticipated/applicable, is estimated on Page 2 of Exhibit B.

Budget Justification (Exhibit B1)

The proposed Exhibit B1 will contain the budget justification for the entire project period and will be incorporated in the agreement as Exhibit B1.

The following items pertain individually to the completion of the proposed budget. If a given budget category in subsequent years is escalated greater than 5%, additional justification for that category is required for the subsequent years.

Personnel

Name. Starting with the Principal Investigator list the names of all known personnel who will be involved on the project during each year of the proposed project period. Include all collaborating investigators, individuals in training, technical and support staff or include as “to be determined” (TBD).

Role on Project. Identify the role of each individual listed on the project. Provide budget narrative in Exhibit B1, for ALL personnel by position, function, and a percentage level of effort. Include any “to-be-appointed” positions.

Institutional Base Salary. Enter the Institutional Base Salary for each individual listed on the budget. Institutional Base Salary is the annual compensation paid by the University for an employee’s appointment, whether that individual’s time is spent on research, teaching, or other activities. If salary increases are expected in future years, be sure the budget reflects such salary increases. The budget is a projection of the anticipated costs of a project. While the University will only invoice the sponsoring State agency for actual costs incurred, it is important to budget for any anticipated escalations in salaries or benefits (especially for multi-year projects).

Percentage of Effort Devoted to Project. Enter the percent of effort devoted to the project. Effort will be proposed consistent with the University compensation of the employee. If the employee is paid a salary, the % of Effort will be used. If the employee is paid by the hour, then enter number of hours proposed per year in the % of Effort column.

Salary Requested. The amount of salary being requested for each budget period is calculated based upon the level of effort and the individual’s institutional base salary.

If an unanticipated salary increase causes the budget category change to exceed the agreed upon budget flexibility, the University will request an amendment to the budget. As the State relies upon an accurate budget proposal to determine project costs and allocate resources accordingly, the University, to the extent possible, shall include all anticipated salary increases in the initial proposal.

Fringe Benefits. Fringe benefits will be requested in accordance with institutional guidelines for each position. Tuition and fee remission for graduate student employees is part of a graduate student’s benefit package. Most often, such costs are listed under the Fringe Benefits category. However, some state agencies have requested that tuition and fee remission for graduate student employees be listed in the “Other Direct Costs” category. Tuition and fee remission is excluded from the IDC calculation as tuition is not included in the MTDC base.

To the extent possible, the University shall include all anticipated increases to fringe benefit rates in the initial proposal.

Travel

Itemize all travel requests separately by trip and justify in Exhibit B1, in accordance with University travel guidelines. Provide the purpose, destination, travelers (name or position/role), and duration of each trip. Include detail on airfare, lodging and mileage expenses, if applicable. Should the application include a request for travel outside of the state of California, justify the need for those out-of-state trips separately and completely. As UC and CSU are not subject to Cal HR travel rates, DGS, CSU and UCOP agreed that University travel will be reimbursed at University rates under the UTC. See Section 13 of the UTC (Exhibit C) (PDF).

It is important that travel under a CMA-funded project comply with Assembly Bill 1887. AB 1887 restricts the use of State General Funds to pay for travel costs to states that have laws that discriminate based on sexual orientation, gender identity, and gender expression, or to states that have passed a law repealing such protections. The Attorney General maintains a listing of states impacted by this legislation, as well as exceptions.

Materials & Supplies

Itemize materials and supplies in separate categories, such as instructional supplies, chemicals, radioisotopes, etc. Include a complete justification of the project’s need for these items in Exhibit B1.

Theft sensitive equipment (under $5,000) must be justified and tracked separately in accordance with State Contracting Manual Section 7.29.

Equipment

List each item of equipment (greater than or equal to $5,000 with a useful life of more than one year) with amount requested separately and justify each purchase in Exhibit B1. In addition to the justification in Exhibit B1, provide details about the cost of the equipment or the aggregate components (when the aggregate total is greater than or equal to $5,000) and quotes if available.

"7.29 • EQUIPMENT PURCHASES (Rev 11/12)

A. When equipment is purchased or built with State funds as part of the contract the contract must clearly state that title to any equipment purchased or built with State funds will vest in the State. On termination of the contract, the State may:

- Request such equipment be returned to the State, with costs incurred by the contractor for such return being reimbursed by the State.

- Authorize the continued use of such equipment for work to be performed under a

different agreement or contract."

Note: Title to state-funded equipment is subject to SCM 7.29, unless otherwise stated in an Exhibit G.

Consultant Costs

An independent consultant is an individual not employed by the University who primarily provides professional or technical advice to the University without the University controlling the manner, means or methods of performance. Consultants are individuals/organizations who do not provide a percentage of effort to the project or program, but rather provide expert advisory or other services for brief or limited periods of time during the period of performance. Consultants are not involved in the scientific or technical direction of the project as a whole.

Provide the names and organizational affiliations of all consultants. Describe the services to be performed in Exhibit B1. Include the number of days of anticipated consultation, the expected rate of compensation, travel, per diem, and other related costs.

Subawardee (Consortium/Subrecipient) Costs

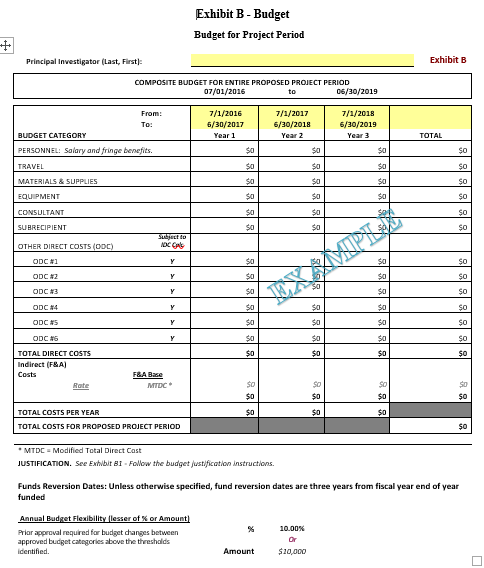

Each consortium organization participating in the programmatic objective of the project must provide a separate detailed budget for every year in the project period as detailed in Exhibit B2 Subawardee Budgets.

Subawards to consortium organizations usually involve personnel costs, supplies, and other allowable costs, including associated indirect costs.

Include a complete justification for the need for any subrecipient listed in the application in Exhibit B1, along with budget information for the initial budget period and subsequent budget periods (if applicable).

Other Direct Costs (ODC)

Itemize any other expenses by category and cost. These might include animal maintenance (unit care costs and number of care days), tuition remission (if not treated as a fringe benefit by University policy), participant payments, publication/printing costs, computer charges, equipment maintenance, service contracts and rental expense (apart from off-site facility rental, described below). Contractual costs for support services, such as the laboratory testing of biological materials, clinical services, or data processing, are occasionally sufficiently high to warrant a categorical breakdown of costs. Specifically justify costs that may typically be treated as indirect costs. For example, if insurance, telecommunication/IT costs are charged as a direct expense, explain reason and methodology.

Rent

If the scope of work will be performed in an off-campus facility rented from a third party for a specific project or projects that is not included in the University’s negotiated IDC rate, rent may be charged as a direct expense, will not be subject to the indirect cost calculation.

Any exceptions must be justified in Exhibit B1. If the project does not support the full rental expense, then the rental expense should be prorated in accordance with the benefit to the project and the allocation amount or percentage will be identified and explained in Exhibit B1.

Indirect Costs (IDC)/Facilities & Administrative (F&A) Costs

Although California Education Code 67327(a) proposed that DGS, UCOP and CSUCO include in the CMA a provision regarding Administrative overhead and indirect costs, the parties were unable to reach agreement on such term. Therefore, there is no contractual or legally agreed upon indirect cost rate for state agreements to UC or CSU campuses. Indirect costs for each project must be mutually agreeable between the state agency and university in order for the project to proceed.

For all campuses of the UC and CSU systems, the budgeted IDC rate listed in Exhibits B and B2 will remain in effect for the entire funded project period of an agreement, unless the University is acting as a federally-funded subrecipient of a state agency pursuant to 2 CFR §200.93 (PDF). Any additional funds not originally obligated and awarded will be subject to (i) the federally-funded subrecipient rate agreement (for federally funded projects) or (ii) a rate mutually agreed upon by the parties (for non federally funded projects).

If the State will fund the proposal using federal funds as a pass-through entity, the University may be acting as a subrecipient, as defined in 2 CFR § 200.93 or a contractor, as defined in 2 CFR § 200.23 (PDF). The State will make the determination of whether the University is acting as a subrecipient or a contractor in accordance with 2 CFR § 200.330 on a project-by-project basis. In such cases where the University is acting as a subrecipient, the University will apply its federally negotiated F&A costs as required by 2 CFR §200.414 applied against the Modified Total Direct Cost (MTDC) base, using the federal definition, “MTDC means all direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and up to the first $25,000 of each subaward (regardless of the period of performance of the subawards under the award). MTDC excludes equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each subaward in excess of $25,000.” (see 2 CFR §200.68 (PDF)).

The federally-negotiated rate may escalate over time in accordance with the negotiated F&A Rate Agreement of the campus. Where the campus is acting as a federally-funded subrecipient of a state agency pursuant to 2 CFR §200.93, the escalation in the federally-negotiated rate must be captured in Exhibit B for the appropriate project period(s) as mandated by 2 CFR §200.414. University campuses are encouraged to share their federally negotiated F&A Rate Agreement with sponsoring State agencies.

Subawardee Budgets (Exhibit B2)

Whenever feasible, subawardees should be expressly identified in the proposal. However, in instances where it is not feasible or reasonable for early identification of subawardees, or a change in subawardee is necessary, the agreement can be amended by mutual agreement of the parties as noted in the UTC at Section 11 (PDF).

Each participating subawardee organization must submit a separate detailed budget(s). Include in the Justification, Exhibit B1, the need for, and qualifications of, any subcontractor. Exhibit B2 for each subawardee should follow the same format as Exhibit B (for the university).

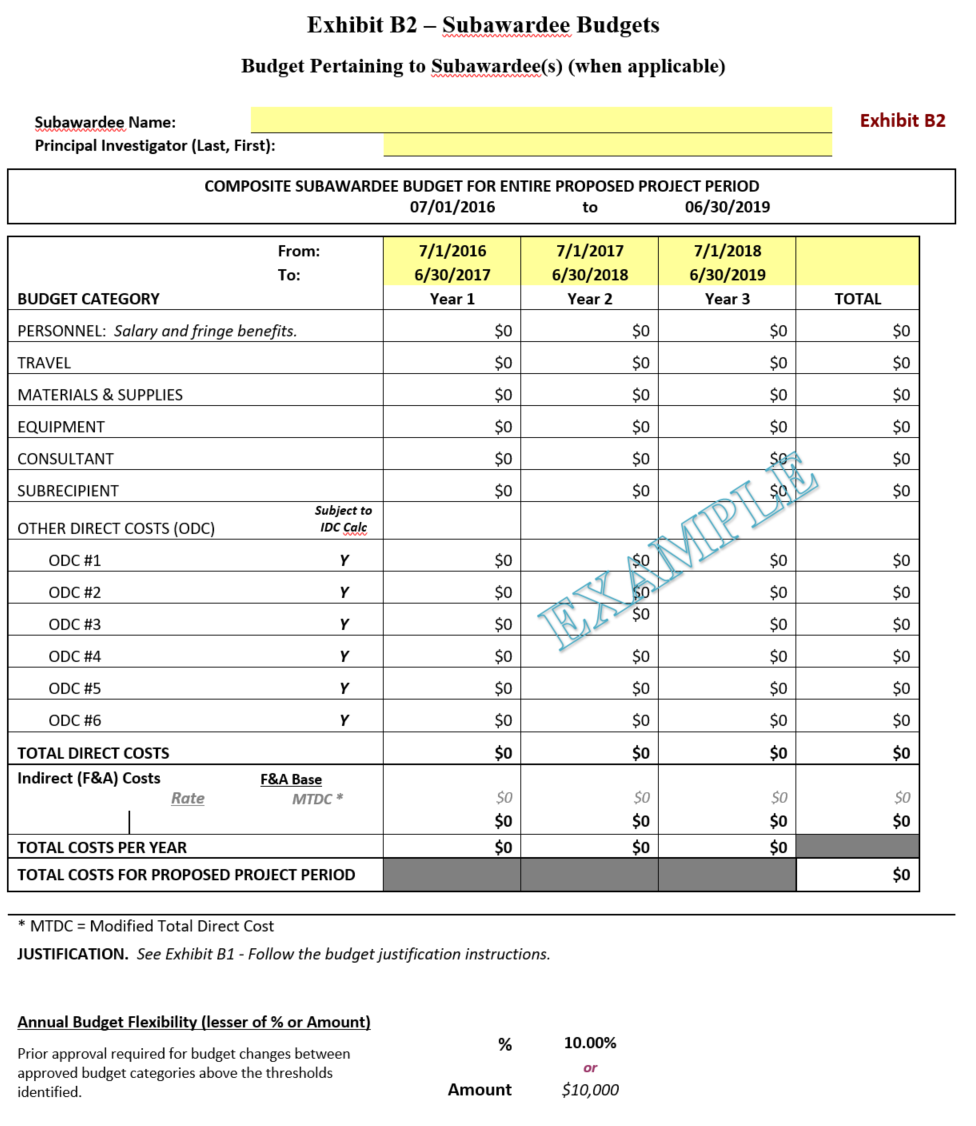

Invoice Elements (Exhibit B3)

Exhibit B3 specifies the invoicing frequency and signature format, and contains the information and data elements that will be required on University invoices to State agencies. The standard Exhibit B3 will be incorporated in the final agreement. Subject to any project-specific Exhibit G, Universities are required to include all of the invoice elements in their invoice, whether in one document or multiple documents. If this can’t be done, the university should contact their system office to discuss alternatives.